To: The Members of the City Council

Subject: City of Sausalito’s Fiscal Year 2026 Budget Earns an F

We have reviewed the City of Sausalito’s Fiscal Year 2026 Budget report from an educated layman’s viewpoint and give the report an “F” for ignoring the financial impact of major issues such as operating deficits, asset maintenance and a general lack of transparency. We are not commenting on the technical aspects of the accounting report, and we leave that to others, such as the two Certified Public Accountants who submitted a letter to you on the same subject. We should also note that we do not fault the current interim finance director as he is not a certified public accountant and has been placed in an untenable situation.

Operating Deficits: For a number of years, the City Council has resolved general fund operating deficits by transferring money from enterprise funds, such as the Parking and the Martin Luther King (MLK) funds. Historically, these enterprise funds were only tapped in emergency situations but, as of the last five to ten years, they have been treated like slush funds. Last year we warned the City Council that these funds had expense obligations and the Council could not simply look at the gross receipts of these funds. The then CFO admitted that the MLK fund had minimal reserves.

The City's response in this year's budget (Agenda Item 5A) was:

· Renamed the “Enterprise Funds” as “Rental Funds”; we had to ask AI for a definition of “municipal finance rental fund” and found the following:

“A municipal finance rental fund, also known as municipal lease financing, is a way for local governments and other public entities to acquire assets by making lease payments over time, rather than through a large upfront purchase. This type of financing is often used for essential items like vehicles, equipment, and even buildings.”

So it appears the structure of the purchase of the former Bank of America building could qualify as a Rental Fund but to similarly categorize the Parking and MLK funds is arbitrary and potentially misleading.

· Added a heading to this “Rental Fund” section (Agenda Item 5A, Attachment 3) to the effect “City Council has full discretion to use collected revenue subject to potential lease requirements”; (NOTE: at the very least this heading should be expanded to include asset maintenance costs and debt payments in the ‘subject to’ clause); and

· Planned to transfer $500,000 from the MLK fund to the General Fund, leaving only a mere $140,000 in the MLK fund. This is particularly short sighted given the cash needs for the MLK campus as projected in the City’s recent third-party asset management assessment (Agenda Item 5A, attachment 5, slide 11; see graphic below). No mention of this assessment is made in the budget.

A more detailed assessment of the MLK Campus was done in 2015, again projecting significant maintenance figures over the period 2015-2024. It too appears to have been ignored. In short, the City seems to be covering General Fund deficits by ignoring the cash needs of its facilities.

Asset Maintenance: As noted with respect to the MLK, the budget ignores the costs to maintain buildings despite the projections of recent third-party asset management assessment. Examples:

To be clear, this failure to fund the assessment’s projection of asset management cost has little, if any, immediate effect on General Fund surpluses or losses as the funding of the maintenance should come from the respective Enterprise/Rental Fund. What it does mean is, if the City continues to push these maintenance costs to later years, the costs are likely to soon consume most, if not all, of an Enterprise/Rental Fund’s annual revenue and assets. The Enterprise/Rental Fund would no longer be able to serve as a slush fund for the General Fund.

The City got a small taste of this problem in this current budget. The initial plan, if you track the paperwork, was to transfer $700,000 from the MLK Fund to the General Fund (Agenda Item 5, Attachment 4). The problem was taking the $700,000 from the MLK fund would have depleted the Fund’s assets and pushed it into the red. The revised plan reduced the transfer from the MLK Fund by $200,00 to $500,000 and increased the transfer from the Parking Fund by $200,000 to $1,700,000. And we truly hope the primary tenant at MLK does not depart.

In the coming years, there will be more and more pressure on the Parking Fund to serve as the primary slush source for the General Fund. We are not sure the Council gets this idea as more and more parking spaces are removed from service.

Other Items of Note in the Budget

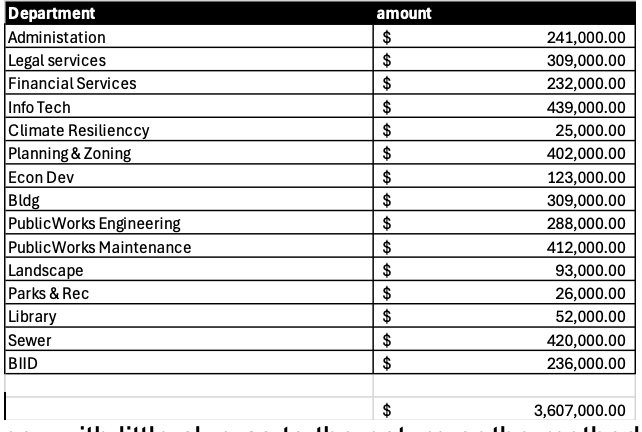

Professional Service Fees. Amongst the various departmental budgets, there is a total of $3.6 million of “Professional Service Fees”, including legal.

It is a lot of money with little clue as to the nature or the method for determining each department’s amount. There needs to be more transparency on the larger items, say over $100,000.

Insurance. The cost figures for insurance are not clear. The City had been part of an insurance pool Bay City Joint Powers Insurance Authority (BCJPIA) but in 2023 was asked to leave due to the City’s high volume of claims. The City’s 10-year loss history made finding a new insurer difficult.

The last information we can find on the subject is a Staff Report from May 7, 2024, and identifies Public Risk Innovation, Solutions, and Management (PRISM) as the likely insurer. The annual premium was projected to be $1 million with a “retention” of $500,000.

The liability insurance budget figures are $1,300,000 under Non-Departmental and $500,000 under the Sewer Operating Fund. There is an additional $150,000 for Property Insurance under Non-Departmental. There is no mention of whether any money is allocated to retention.

So what is retention and what role does it play? The City has apparently been relegated to “bad person” status for insurance purposes and the coverage structure changes. Say the coverage was quoted as a $1,000,000 premium with a retention of $500,000. Under such coverage, the City would have to pay out claims up to the retention amount of $500,000 before the insurer would provide coverage for a claim.

But let us be clear, we are guessing at the terms and amounts of this insurance coverage, and we should not have to. More transparency is definitely needed on this critical subject both on costs and the program to reduce claims.

Now you understand why we have given this budget an F:

· The short-sighted view of continuing to cover General Fund deficits with transfers from enterprise funds currently, or projected to be, under stress;

· The failure to include third-party projections of annual asset maintenance costs in the budget;

· The complete lack of transparency regarding “Professional Service Fees” line items totaling $3.6 million;

· The complete lack of transparency regarding Insurance Costs and the coverage structure; this area is critical given the City’s significant 10-year loss history.

There was much celebration when the Council completed its review of this budget document on June 17th and determined, to us erroneously, that the budget was balanced. One councilmember even claimed there was a $4 million surplus. A “celebrity endorser” in the form of a former council member rose to glowingly endorse the budget,

We would like nothing more than to join in this celebration, but you would have to prove us and two CPAs wrong. Good luck.